|

People often talk about probate and avoiding probate, but do you really know what probate means and what it entails? Check out this short video for a brief explanation! For a more detailed explanation, check out these resources!

0 Comments

By Attorney Kelly Jesson

This year, make a resolution to prioritize estate planning. Estate planning allows you to gain control and peace of mind over difficult and unpredictable situations. We have previously written about the difficulties caused by dying without a will in North Carolina and the pitfalls of the probate process in North Carolina; however, many of the “worst-case” scenarios can be avoided with proper planning. Let us help you make 2024 the year you plan for emergency scenarios and protect your business and personal assets for the benefit of your loved ones through estate planning. Estate planning allows you to plan for what happens when you pass away, including naming a trusted person to handle your final affairs, name guardians for minor children, and distribute your assets according to your wishes. In addition to planning for death, our office drafts durable and health care powers of attorneys, where you can name agents to make both financial and medical decisions for you if you are incapacitated and cannot communicate. There is no reason to wait to do planning, as you should get a plan in place before it is ever needed. If you do become incapacitated or ill, it may be more difficult or impossible to get documents in place, as you must have testamentary capacity to create valid estate planning documents. Some of our clients delay estate planning because they do not have any friends or family members they trust to serve in fiduciary roles. In some circumstances, members of the firm may serve in these roles for the client if the client feels comfortable. It is better for you to take control and name someone yourself than to have the government appoint someone in an emergency or when you pass away. We want to help you take CONTROL in 2024! Please call Jesson & Rains if you have questions about getting your estate plan in order or updating an existing estate plan. While You Build, We Protect. By Associate Attorney Katy Currie

As the holiday season rolls around, our focus often shifts to spreading joy, giving gifts, and cherishing time with loved ones. However, amidst the festive cheer, there might be family dynamics that don't always align with the holiday spirit. If you find certain family members perpetually landing on the metaphorical “naughty list,” it might be time to consider updating your estate plan to ensure your wishes are safeguarded regardless of family conflicts or disputes. If certain family members have a history of conflicts or strained relationships, it's crucial to communicate your intentions clearly in your estate plan. Explicitly outlining your decisions regarding asset distribution, guardianship, or decision-making authority in your estate plan can help avoid ambiguity and potential disputes. In some cases, you may want to explore options to protect your assets or ensure they are utilized according to your wishes, especially if you are concerned about how certain family members might handle their inheritance. Without a will or living trust, your assets would pass according to the intestacy laws of North Carolina. This takes away the control you have over who inherits when you pass away and could have huge implications on your loved ones. Additionally, in North Carolina, a will is the only way to name a guardian for your minor children in the event that both parents pass away. Furthermore, some people may require more complex estate planning depending on their family situation (such as second marriages, a child with special needs, or care of minor children) and the type and amount of their assets. Estate planning through devices such as living trusts allows you to put plans in place to address the specific needs of your beneficiaries, avoid the probate process, and address more complex tax issues depending on your assets. Finally, a comprehensive estate plan not only plans for what happens after death, but also addresses who would be responsible for making decisions on your behalf if you became incapacitated during your lifetime. This includes naming someone to make financial decisions on your behalf and someone to make medical decisions on your behalf. Without such a plan, your family may have to go through more drastic and expensive court proceedings to have you deemed legally incompetent by a judge. While it's essential to address concerns about family dynamics in your estate planning, doing so should be approached with careful consideration and guidance from professionals. The goal is not only to protect your assets but also to ensure your intentions are upheld and respected, even in challenging family situations. As you prepare for the holiday season, take a moment to consider the importance of estate planning in securing the future for yourself and your loved ones, even when navigating the complexities of family dynamics. If you approach the topic with honesty, care, and thoughtfulness, it could help you get the ball rolling on making important decisions for your estate plan that will have a positive impact on your family for years to come. Jesson & Rains, PLLC wishes you a joyous holiday season filled with love, laughter, and thoughtful planning for the future! By Associate Attorney Danielle Nodar

Starting on January 1, 2024, the Corporate Transparency Act (“CTA”) will require almost all businesses to submit a report to the Financial Crimes Enforcement Network (“FinCEN”) containing personal information about the reporting company’s “beneficial owners.” This law was enacted to help combat global terrorism and money laundering but has consequences for many small business owners who up until now have been able to maintain their personal privacy while owning and operating a business. In addition to the standard business information that one might submit to the Secretary of State, the CTA requires each business to provide personal information related to its “beneficial owners.” A beneficial owner is defined as a person who, either directly or indirectly, exercises “substantial control” over the business or who owns or controls at least 25% of the ownership interests in a business, such as stocks, voting rights, or interests in profits. A beneficial owner also includes a person in their individual capacity as managing the business, such as an LLC Manager, Board Member, or CEO, or it can be someone acting in their capacity as a fiduciary such as a Trustee of a trust that owns an interest in a business. The required filing includes the individual’s full legal name, date of birth, current residential address, an identifying number from a non-expired government ID like a US passport or US driver’s license, and a copy of the ID document. This information must be uploaded to FinCEN’s website once it goes live. Businesses that were formed before January 1, 2024, will have the entire year to submit their first report, so for existing business owners reading this, there is no need to panic! However, businesses created after January 1, 2024, must file their initial report within 90 days of the business’s formation. Starting in 2025, the initial report will be due 30 days after formation. After the initial report, businesses only have to submit information to FinCEN if there is a change to the reported information (not annually like the report to the Secretary of State). There are hefty fines associated with willfully failing to comply or falsifying information on the reports, including a $500 per day fine for a continuing violation, up to a maximum fine of $10,000, and criminal penalties that may include up to two year’s imprisonment. The CTA applies to businesses that are formed or registered to do business in the U.S. by filing a document with a government office. There are certain entities that are exempt from the CTA’s reporting requirements, such as nonprofits and large operating companies that are already subject to regulatory oversight such as publicly traded companies, insurance companies, and registered investment companies. A trust itself is not a business subject to the CTA; however, if a trust is an owner of a business subject to the CTA, the trust may need to provide identifying information about its beneficial owners to FinCEN. Jesson & Rains is working with our current and new business clients to assist with understanding and complying with the CTA’s new reporting requirements. For all new businesses formed by the firm in 2024, Jesson & Rains will submit the initial report on behalf of the business. For our business clients that are members of our Annual Business Maintenance Plan, we will submit the initial report for 2024 and can assist with filing any amended reports so long as you are a member of the Annual Plan. If you are interested in having Jesson & Rains handle these reporting requirements for you, please give us a call! More information on our Annual Plan services can be found here By Shayla Martin

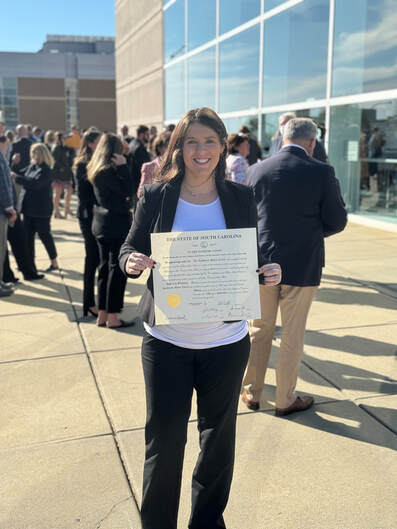

We are thrilled to announce the new licensure of attorney Katheryn “Katy” Currie in the state of South Carolina. Katy initially joined our team in November of 2022 with licenses in North Carolina as well as Alabama. Katy has been a dedicated and passionate advocate for her clients for several years, and her expansion into South Carolina is a testament to her commitment to providing exceptional legal services. Her experience and expertise in various areas of the law, including probate administration, estate planning, and business transactions, will undoubtedly benefit individuals and businesses throughout South Carolina. Along with Katy, our experienced legal team is ready to assist with probate matters, guiding you through the complexities of estate administration and ensuring the smooth transfer of assets to beneficiaries after the death of a loved one. Our estate planning services include wills, trusts, powers of attorneys, and advanced directives, ensuring that your assets are protected and your wishes are honored. Finally, for businesses in South Carolina, we offer a wide range of legal services, including contract drafting, business formation, and more. We're here to help you navigate the complexities of the business world while protecting your interests. Coming Soon: South Carolina construction and litigation services. We’re also happy to announce that partner Edward Jesson passed the South Carolina bar this fall and is expected to be licensed in SC early next year. By Attorney Edward Jesson

On January 5, 2023, the Federal Trade Commission (“FTC”) proposed a rule that would, with limited exceptions, bar employers from using non-compete agreement and would further require the rescission of existing non-compete agreements that were in place prior to the implementation of the FTC’s rule. The FTC’s proposed ban is limited to “pure” non-compete agreements and would likely not apply to customer/employee non-solicitation agreements or others contained in non-employment contracts, such as business sale contracts. It appears as though, from the FTC’s language, that the rule would apply to all employees and all independent contractors. While the FTC initially intended to make a final decision on the rule at some time in 2023, due to the overwhelming number of comments the agency received during the public comment period (nearly 27,000 comments) it appears as though the FTC will not be making a final decision until sometime in April 2024. Even if the rule is implemented, it is highly likely that the blanket ban on non-compete agreements would be challenged in courts throughout the country. While North Carolina has not banned non-compete agreements, its courts strongly disfavor non-compete agreements unless they are narrowly tailored and the North Carolina Court system’s treatment of non-competes is constantly evolving. North Carolina’s treatment of non-compete agreements, as well as the FTC’s proposed ban, are both good indicators of how courts throughout the country are trending in their interpretation of such restrictive covenants. If you think the FTC proposal may affect your business, or you have another non-compete related issue, the attorneys at Jesson & Rains stand ready to assist. |

Subscribe to our newsletter.AuthorKelly Rains Jesson Categories

All

Archives

April 2024

|

|

SERVICES |

SUPPORT |

©Jesson & Rains, PLLC ALL RIGHTS RESERVED.

RSS Feed

RSS Feed