|

By Attorney Edward Jesson

Running a business can be tricky! Having employees can be even trickier! We are frequently asked about minimum wage and overtime. The federal law that controls employee pay is the Fair Labor Standards Act (FLSA). The FLSA sets the minimum standards that the states must comply with—but there is nothing stopping the individual states from setting standards that exceed those outlined in the FLSA. For example, while the federal minimum wage is $7.25 per hour, the minimum wage in Colorado is currently set at $11.10 per hour. If you are an employer in Colorado, you have to pay $11.10 per hour regardless of the federal law. Conversely, no state can set a minimum wage below the federal amount. In North Carolina, the minimum wage is $7.25. Does FLSA apply to your business? Probably, yes. Generally, the FLSA applies to all businesses that make over $500,000.00 per year gross or are engaged in interstate commerce, which is a very broad term. Most businesses engage in interstate commerce. The FLSA can also apply to day workers, housekeepers, cooks, full-time babysitters and other “domestic service workers” under certain circumstances. If you believe that the FLSA does not apply to your business, it would be a good idea to check with a local attorney to ensure that your analysis is correct. Most people know that overtime is calculated at a rate of at least 1.5 times the regular hourly rate. That 1.5 times the hourly rate kicks in for any hours worked over 40 in a single workweek. It’s important to note that the FLSA looks at workweeks and does not allow an employer to average the amount out over a longer period. For example, if an employee works 45 hours one week and 35 the next, the employer cannot average that out to 40 hours per week over those two weeks. The employee will be entitled to 5 hours overtime for the first week, and no overtime for the second week. Even if the FLSA does apply to your business, there are certain exemptions to the law. For example, executive, administrative, and professional employees who earn salaries may be exempt from both minimum wage and overtime pay requirements, so long as that salary is equal to at least $455 per week. Similarly, outside sales employees may also be exempt from FLSA requirements. Employees of movie theaters are exempt from the overtime requirement but must still make minimum wage. Even commissioned employees are entitled to minimum wage (unless they are considered exempt). For example, if a commissioned employee works 30 hours, at the federal minimum wage, they would be entitled to at least $217.50. If the commissions earned for those 30 hours worked totals less than $217.50, then it is the employer’s responsibility to make up the short fall. There are a number of exceptions to this rule. Tipped employees must be paid at least $2.13 per hour in direct payment from the employer. Tipped employees are entitled to at least minimum wage, so if their direct pay and tips for a workweek do not equal what they should be entitled to at the prevailing minimum wage, it is the employer’s responsibility to make up that short fall. Similarly, tipped employees are entitled to overtime pay if they work more than 40 hours in a single workweek. The calculations for a tipped employee’s overtime rate are more complex than for a regular hourly rate employee. As you can see, the exceptions to the FLSA are varied, and there is no “one size fits all” answer. It is advisable to consult with an attorney licensed in your state or a human resource professional to ensure that your employees are being paid the correct amount based on the particular circumstances of your employees and your business. If you have any questions regarding how you are supposed to pay your employees, please give Jesson & Rains a call.

0 Comments

Kelly will be co-hosting a complimentary estate and retirement planning seminar with Joe Roseman, Jr. Managing Partner, who will be talking about retirement, at the South County Library.

Sign up today! *Determine if a TRUST is right for YOU *Avoid the most common mistakes retirees make with their estate plan *Reduce future costs and taxes for your FAMILY *Understand how to avoid letting the NURSING HOME take your house *Discover powerful retirement and estate strategies you never knew existed RSVP using this link Congratulations to our friend, Melisa Galasso of Galasso Learning Solutions, for being named one of The Mecklenburg Times Charlotte’s 50 Most Influential Women!

https://mecktimes.com/50-most-influential-women/?fbclid=IwAR0HC-vPNMWqN4p4pGjKjaNd6v92rqCW5lQr4r5BJHoXWISVgwuC6YGyOu8 Written by Associate Attorney Danielle Nodar

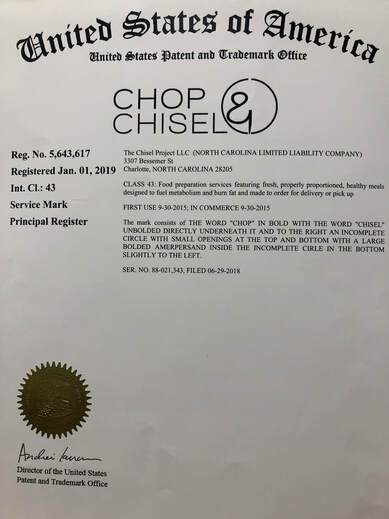

For most assets, the transfer of title from the individual’s name to the name of the trustee of the revocable living trust is a fairly simple process—such as changing the name of a bank account from “John Doe” to “John Doe, Trustee of the John Doe Revocable Trust.” Oftentimes, we can change title for clients by creating a deed or transfer document. For other assets, however, transferring title can be trickier. An example of such an asset is a vehicle. When clients ask us if they can transfer their car into their revocable living trusts, they often get the dreaded lawyer answer: “It depends.” To transfer title of a car to a trust, the owner will have to first check with their insurance company to determine if they will permit the vehicle to be owned by the trustee. This is because some insurance companies have internal policies prohibiting the insuring of vehicles owned by a trustee of a revocable living trust. If the insurance company does allow the trustee to own the vehicle, the next step is updating the registration and title at the DMV to reflect that the ownership of the vehicle has now been transferred. This can often be a cumbersome process requiring multiple trips to the DMV because each office is different in terms of what kind of documentation they may require. For example, while the DMV indicates that a copy of the front and back of the first and last pages of the trust is required for showing proof that a trust is in existence, some DMVs will allow you to use a Certification of Trust instead. All DMV offices will require the owner of the vehicle to fill out a title application (which must be signed before a notary), notarized vehicle title, proof of the trust, and acceptable identification for the owner. There will also be fees, and, in some cases, taxes imposed for transferring the title and registration. If you have any questions about titling vehicles or any other property in a revocable trust, or creating a revocable trust in the first place, please give Jesson & Rains a call! Congratulations to our client, Chop & Chisel, on the successful registration of trademarks and on the opening of their second location (uptown)! They create healthy grab and go meals and even deliver to just about anywhere.

Please contact Jesson & Rains if you are interested in obtaining a trademark for your business. |

Subscribe to our newsletter.AuthorKelly Rains Jesson Categories

All

Archives

July 2024

|

|

SERVICES |

SUPPORT |

©Jesson & Rains, PLLC ALL RIGHTS RESERVED.

RSS Feed

RSS Feed