|

By Attorney Kelly Jesson

After a lot of delay on both sides of Congress and the President, we have a new COVID-19 stimulus law. The President signed the “Consolidated Appropriations Act, 2021” on December 27, which contains a lot of government funding measures in addition to the COVID relief/stimulus provisions. Below are some highlights – what we think individuals and business owners would like to know: Foreclosure, Evictions, and Student Loans There are no provisions in the new law extending foreclosure forbearance or student loan forbearance. However, the President and government agencies have taken matters into their own hands since the first CARES Act was originally passed, frequently extending these deadlines. Currently, student loan deferment is scheduled to expire on January 31, 2021. FHA borrowers through February 28, 2021, can request forbearance of up to 12 months of mortgage payments. The new law does extend the eviction moratorium (for tenants with less than $99,000 annual income) through January 31, 2021, but again this can be extended by the government at any time. Lots of money was appropriated to the states for rental assistance programs. Unemployment Benefits Pandemic unemployment assistance will continue for up to an additional eleven weeks if eligible, through March 14, 2021. If eligible as of that date, a worker who has not yet received the maximum amount of benefits may continue to receive benefits through April 5, 2021. Eligibility requirements did not change. Workers with at least $5,000 in self-employment income may be eligible for an additional $100 per week benefit as part of the Mixed Earner Unemployment Compensation. Federal Pandemic Unemployment Compensation (the extra payments of $600 per week) will be reduced to $300 per week but will continue for up to an additional eleven weeks if eligible, through March 14, 2021. Eligibility requirements did not change. Tax Rebate Many eligible individuals (eligibility requirements did not change in this new law) will receive another tax rebate in the following amounts: • $600 ($1,200 in the case of eligible individuals filing a joint return), plus • $600 for each qualifying child • But the credit shall be reduced by 5 percent of so much of the taxpayer’s adjusted gross income as exceeds: • $150,000 in the case of a joint return, • $112,500 in the case of a head of household, and • $75,000 in the case of a taxpayer not described above. This means that a married couple filing jointly with no children will not receive any credit if their income is $174,000. Paycheck Protection Program (“PPP”) Lots of exciting news here! Congress has allocated funds to a “second draw PPP loan program.” The available loan amount is the same, and the business must have been in business on February 15, 2020 (like before) to be eligible, but the second draw is only available to businesses with not more than 300 employees (first round was 500). Like before, there are special rules for seasonal businesses and those with more than one location. At least 60% of the loan must be spent on payroll, like before, to be forgiven; however, Congress did broaden the types of permissible expenditures. Forgivable business expenses now include covered operations expenditures (payment for any business software or cloud computing service that facilitates business operations, product or service delivery, the processing, payment, or tracking of payroll expenses, human resources, sales and billing functions, or accounting or tracking of supplies, inventory, records and expenses), covered property damage costs (related to property damage and vandalism or looting due to public disturbances that occurred during 2020 that was not covered by insurance), covered supplier costs (essential to the operations of the entity and made pursuant to a contract that existed prior to the covered period or perishable items), and covered worker protection expenditures (related to making customers and employees safe from COVID-19). Additionally, the forgivable health insurance expense clause in the CARES Act was amended by the new law to include other type of insurance, such as group life, disability, vision, or dental insurance. If a business has already applied for and received forgiveness for its first PPP loan, it cannot go back and amend the application to include these new expenses. However, if a business has not had its first PPP loan forgiven yet, it can go back and calculate money spent on these new permissible expenditures and include these on its forgiveness application for the first round of PPP loan. In order to qualify for a second draw PPP loan, the business must have suffered an at least 25% drop in gross receipts for a quarter in 2020 than the same quarter in 2019. If the business wasn’t in business in 2019, then it must have suffered a 25% drop from the first quarter of 2020 as compared to one of the other three quarters of 2020. Any amounts forgiven under the PPP will no longer be included in the business’s gross income. The new stimulus law also created a simplified certification process for forgiveness of loans no greater than $150,000. EIDL Emergency Grants A business no longer has to pay back / deduct from the PPP forgiveness amount money it received as part of the emergency grant of up to $10,000. If you’ll recall, the SBA limited the grants to $1,000 per employee, and the money ran out at some point. The new law provides additional funding for these grants, and there is no language in the law limiting the grant to $1,000 per employee (although the maximum amount is still $10,000). To qualify, the business must: be located in a low-income community; have suffered an economic loss greater than 30%; and employ not more than 300 employees. In addition, the business must qualify as an eligible entity as defined in the CARES Act. If a qualifying business has already received a partial grant, it can apply for the remaining balance of the $10,000. EIDL Loans Recipients will enjoy an additional three months of payments paid by the SBA, and some qualifying businesses may receive eight months. The maximum amount of payments is still $9,000 per borrower per month. Other The refundable payroll tax credits for paid sick and family leave, enacted in the Families First Coronavirus Response Act, have been extended through the end of March 2021. The CARES Act rules dealing with retirement distributions have been extended through April 30, 2021.

0 Comments

By Attorney Kelly Jesson

Amendments to the Payroll Protection Program (“PPP”) that have been discussed for weeks finally made it to law on Friday. The amendment makes six major changes: 1) Forgiveness period possibly extended: The definition of “covered period” has changed to give businesses the option of choosing the eight-week period, or the earlier of 24 weeks or through December 31, 2020. This enables businesses to have more time to spend PPP money on forgivable expenses, thus increasing the likelihood that the entire loan may be forgivable. However, there’s a catch: because the “covered period” has extended, the business owner needs to maintain payroll levels appropriately under the CARES Act during the extended period in order to obtain full forgiveness. Thus, some business owners may opt to keep the shorter 8-week period. 2) Businesses need only spend 60% of the loan on allowable payroll expenses: This is a decrease from 75%, which is not in the CARES Act but was made a rule by the Treasury Department. It obviously has a negative effect on businesses that have large rental or mortgage expenses. Now, they can use 40%, instead of 25%, on rent, mortgage, and utilities and still have that part forgiven. 3) New PPP loans allowed to be paid off within five years: This is an increase from two years. While this only applies to new loans, existing lenders may allow existing borrowers to take advantage of this term as well. 4) Businesses may not be penalized if they cannot rehire workers or resume business during the covered period: As mentioned above, the amount of forgiveness depends on a business’s ability to pay covered expenses (60% has to be payroll) and re-hire or maintain its workforce. What if it CANNOT reopen due to mandatory closures? The PPP amendment exempts businesses from being negatively affected by these requirements if the business in good faith documents: (1) both the inability to rehire individuals who were employees on February 15, 2020 and the inability to hire similarly qualified employees for unfilled positions by December 31, 2020; or (2) the inability to return to the same level of business activity it enjoyed before February 15, 2020, due to compliance with government closures or federal safety and sanitation requirements related to COVID-19. 5) Repayment deferral period has been extended: Instead of it being deferred for six months, the amendment defers repayment until the date the amount of forgiveness determined is remitted to the lender. This is beneficial because business owners won’t have to start repaying the loan without knowing how much they actually have to repay (makes sense, right?). However, if a borrower fails to apply for forgiveness within 10 months of the last day of the covered period, repayment must begin on that date (10 months after the last day of the covered period). 6) Payment of employer payroll taxes delayed: Businesses can delay the payment of employer payroll taxes until December 31, 2021 (up to 50% of the amount due) and December 31, 2022 (the remaining amount due). Prior to this amendment, businesses were prohibited from taking advantage of this benefit if its PPP loan was forgiven in whole or in part. These changes are certainly welcome to business owners. Keep in mind, though, the Treasury Department and Small Business Administration still have the ability to provide further rules and regulations, so business owners should keep their eyes and ears open in order to fully take advantage of the PPP! Please contact Jesson & Rains with any questions! By Attorney Kelly Jesson

Business owners around the country are starting to reopen their businesses up to employees and customers. However, regardless of government announced “phases,” businesses owe a duty to their employees and customers to keep them safe while on the premises. Lawsuits are starting to pop up, according to Market Watch. What can you do to limit your potential liability? Businesses should follow healthcare and government recommendations, such as wiping down surfaces, frequent hand washing, wearing masks, socially distancing, etc. These recommendations sometimes change, so business owners should stay abreast of updates. Keeping your employees from getting sick on the job in the first place is key: in a worker’s compensation case, all the worker has to do is prove they were injured on the job and there’s a causal connection between the two. For example, a grocery store cashier may have a claim due to exposure to the public. A worker’s compensation claimant does not need to prove that the business was negligent. For businesses that don’t have a large volume of public traffic (such as law firms), owners may ask patrons to sign a document before coming into the premises stating that they do not have COVID-19, are experiencing no symptoms, and they have not been around anyone with COVID-19 or who has otherwise been experiencing symptoms. While patrons can, of course, lie on these forms, at least it’s one additional step that business owners can show that they are taking to protect their employees and other customers. Showing that you are taking the necessary steps to keep people safe is important in defense of personal injury lawsuits, where the plaintiff has to show not only causation (that they caught COVID-19 at your business) but negligence (that you failed to act with reasonable care). A defense to a negligence action is “assumption of risk.” Some business owners may ask patrons to sign waivers of claims, saying that the patron is “assuming the risk” of contracting COVID-19 by coming to their establish. For example, someone who voluntarily eats at a restaurant or goes to a nail salon knows that there is a risk that they may be infected, and a business is not guaranteeing 100% that they will not be infected, because there’s no way to do that. Governor Cooper provided business owners with extra protection a couple of weeks ago when he signed the Coronavirus relief bill. The act provides for limited liability for businesses deemed “essential” under the Governor’s prior stay-at-home order. If an employee or customer gets COVID-19 from spending time at an essential business, the business is not liable for damages unless it is “grossly negligent” or worse. Gross negligence is a higher standard than simple negligence. Instead of a plaintiff showing the absence of reasonable care in a negligence lawsuit, a plaintiff would have to show the conscious disregard for reasonable care to prove that a business was grossly negligent. While essential businesses should be comforted by this law, we are of the opinion that this should not change how they do business. In fact, if they consciously fail to abide by social distancing and cleaning protocols, they could arguably be grossly negligent. If you have any questions about how to prepare your business for reopening, give Jesson & Rains a call! By Associate Attorney Danielle Nodar

During this time of uncertainty, people may question whether they have their affairs in order to better protect themselves, their loved ones, and their assets in the event that a worst-case scenario occurs such as incapacity brought on by illness or death. Below is a short list and description of important documents that can help complete an estate plan. The documents that deal primarily with distributing assets at death are a will or a revocable living trust. The best type of document for a given individual depends on a variety of factors such as family situations, the type or amount of assets, and overall goals for estate planning, but both documents allow you to have control over who will be responsible for carrying out your final wishes and ensuring that your assets are distributed to the beneficiaries you have named in your documents. For parents, there are also important decisions relating to caring for your children if you pass away. Unless you have a terminal illness, the only way to name a guardian for your children in North Carolina is to do so in a will. When appointing a guardian for a minor, the court will give preference and priority to the person named as guardian in a will. By law, a child can inherit property outright and with no strings attached upon reaching the age of eighteen, regardless of the amount or type of property. With proper estate planning, your will or living trust can outline specific age restrictions or conditions on when your child can inherit your property while ensuring that all expenses relating to your children’s health, support, maintenance, and education are taken care of by a trustee. A durable power of attorney allows you to name an agent to act in your place and make financial, business, and legal decisions if you ever become incapacitated (i.e. unable to handle your affairs). In the absence of naming an agent, a loved one would have to petition the court to be appointed as your legal guardian. The guardianship process is much more cumbersome, time-consuming, and costly than executing a durable power of attorney in advance. A health care power of attorney allows you to name an agent to make medical decisions on your behalf in the event you cannot speak for yourself. This document is not necessarily an end-of-life document, as it can apply in any situation where you are unable to communicate your wishes to a physician, such as being under anesthesia. You may give your agent full authority over decisions relating to your physical and mental health or limit your agent’s authority by providing explicit instructions in this document. An advance directive, also known as a Living Will, is an end-of-life document where you will state under what conditions and terms you do not want to be kept on life support such as a ventilator, artificial nutrition, and artificial hydration. In the absence of a Health Care Power of Attorney or an Advanced Directive, North Carolina law sets forth an order of priority (family members) as to who can consent to medical treatment on your behalf in the event you become incapacitated. This can cause problems for people with interesting family situations or no family at all. There is no default decision maker under North Carolina law for business, financial, and legal decisions, so a durable power of attorney is one of the most important estate planning tools we draft. With all of these documents, timing is everything, as the signer must have capacity at the time of signing. You cannot “get power of attorney over” someone. If you are interested in discussing your estate planning goals or needs, please contact Jesson & Rains. By Attorney Kelly Jesson

It’s hard to think about celebrating small businesses this month when so many are suffering due to coronavirus-related closures and illnesses. During this time of crisis, we’re right here with you, navigating these unusual waters. We thought this would be a great time to feature one of our clients, Help Mask A Hero, who saw a life-or-death need and immediately sprang into action to fill the gap! Help Mask A Hero, Inc., is a North Carolina non-profit corporation, with its 501(c)(3) status pending. Founded by Charlotte’s own Dr. Lakesha Legree, owner of Elev8 MD Wellness Center, PLLC, and several other anesthesiologist colleagues, Help Mask A Hero uses donations to purchase coveted N95 masks to ensure that our frontline healthcare workers are receiving the PPE they need to treat COVID-19 patients AND stay healthy themselves. Help Mask A Hero also accepts donations of masks and other protective equipment. Help Mask A Hero has been featured all over major national news channels. We are so proud to serve them! If you’d like more information, or to donate yourself, please visit: https://helpmaskahero.com To honor our healthcare workers, we are offering a discount for those who need their estate planning documents drafted. Please give Jesson & Rains a call for more information! When considering the emergency law that Governor Cooper just signed Monday, most North Carolinians are excited about the $1.6 billion relief package that will go to heath, education, and small businesses.

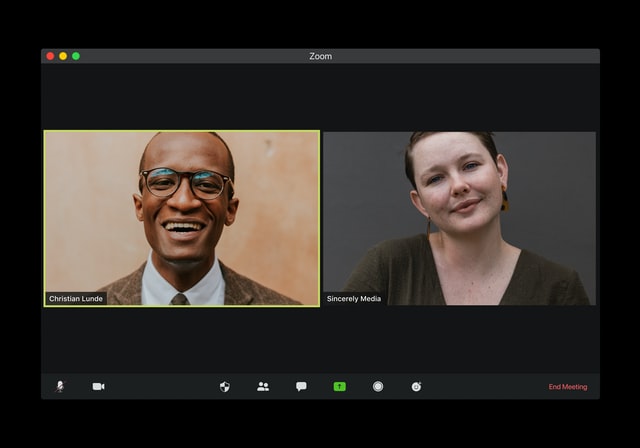

However, attorneys (and their clients) are the most excited about video witnessing and notarization! To deal with COVID-19 and social distancing concerns, documents can now be notarized and witnessed through video conferencing software like “Zoom” and “GoToMeeting.” Unfortunately, the emergency law did not do away with the requirement that some documents be an “original” (with a “wet” signature), so the procedure for will signings is a little clunky, requiring multiple originals to be mailed back and forth. Here’s a breakdown of the new law as it pertains to video notary and witnessing:

The witnesses’ and notary’s acknowledgements must contain special language in light of the emergency law, so do not try this yourself at home! If you need assistance, give Jesson & Rains a call. |

Subscribe to our newsletter.AuthorKelly Rains Jesson Categories

All

Archives

July 2024

|

|

SERVICES |

SUPPORT |

©Jesson & Rains, PLLC ALL RIGHTS RESERVED.

RSS Feed

RSS Feed