|

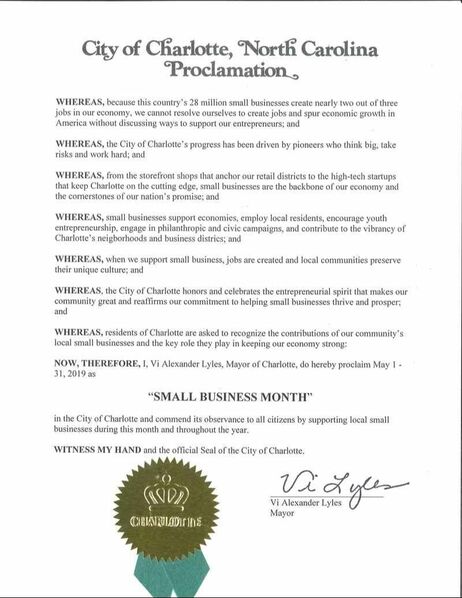

Each year, the Small Business Administration (SBA) designates the first week in May as the SBA National Small Business Week. The City of Charlotte and its small business resource partners have declared May to be Small Business Month 2019. Charlotte Mayor Vi Lyles announced with an official proclamation that the city will be celebrating all month long!

As part of Charlotte’s Small Business Month, CharlotteBusinessResources.com (CBRBiz.com) will be spotlighting a different small business for each day for the month of May. CBRBiz.com supports Charlotte’s small business community in partnership with 26 supporting partners. It is designed to connect entrepreneurs with free resources to start and grow a business in Charlotte, and it provides educational, networking, and mentoring services to Charlotte-area business owners. CBRBiz was founded and is funded by the City of Charlotte. It is an excellent resource for minority and veteran business owners. Did you know that area community colleges have Small Business Centers that offer FREE classes for community member business owners? The classes offered range from how to get your product on store shelves to bookkeeping and designing websites and doing your taxes. The colleges offer two-hour classroom seminars, as well as on-demand computer seminars (in case you cannot attend an in-person class). Using the link below, you can search your local community college for in-person classes as well as searching the catalog of on-demand courses from any school that you can watch from the comfort of your own home. Small Business Center Network Charlotte Mecklenburg Library offers classes for adults ranging from learning computer skills (learning to use Excel, for example) to learning how to apply for grants or file business taxes. CMLibrary Schedule Have you heard of SCORE? SCORE stands for “Service Corps of Retired Executives.” SCORE is a nationwide non-profit with thousands of working and retired business professionals who volunteer to support the success of small businesses. SCORE offers free live and on demand webinars for all things business-related: https://charlotte.score.org/content/take-workshop-249 Not only does SCORE offer webinars, but they offer FREE one-on-one mentoring. The Charlotte chapter has over 75 certified mentors that provide one on one mentoring to business owners and entrepreneurs. Sign up for a mentor here: https://charlotte.score.org/content/find-mentor-282

2 Comments

Kelly was recently featured on CO-Law’s blog!

https://www.colawcharlotte.com/blog CoLaw is an as-needed support platform for independent lawyers. CoLaw offers flexible access to office space and law practice management assistance on a month-to-month basis. In a nutshell, CoLaw helps lawyers grow and manage their law practices more efficiently. North Carolina has a procedure whereby the surviving spouse can claim an “allowance” when their spouse dies, to be satisfied by only the deceased spouse’s singularly owned personal property. Most jointly owned property will automatically become the surviving spouse’s.

The allowance is a superior claim and will be paid out of the deceased spouse’s personal property before any creditors or other claimants are paid. The spousal allowance law applies whether or not the deceased spouse had a will. As of January 2019, the amount of available allowance doubled from $30,000 to $60,000! Only personal property may be used to satisfy the allowance. If a deceased spouse had real estate only in his name, the surviving spouse could not use the spousal allowance to get the real estate and would then have to resort to the probate process. The benefits of the increased spouse allowance statute are clear. Example: you and your deceased wife own a house jointly and own joint bank accounts, but she had a car in only her name worth $30,000 and a stock account only in her name worth $20,000. She also had a $20,000 Macy’s credit card bill in only her name. You can go up to the courthouse with proof of her death and proof of your marriage, fill out a fairly simple form, pay a small fee, and leave being able to transfer those two items to you directly. There is no need for a costly and time-consuming probate proceeding. Additionally, Macy’s will not be paid. It is very important to note that a surviving spouse only has one year to file a claim for the allowance. There are no exceptions to this rule. If the deadline had been missed in the above example, the stock would likely have to be sold to pay the Macy’s debt. Also, there is a $5,000 child’s allowance available for children under the age of 18 or certain children over age 18. |

Subscribe to our newsletter.AuthorKelly Rains Jesson Categories

All

Archives

July 2024

|

|

SERVICES |

SUPPORT |

©Jesson & Rains, PLLC ALL RIGHTS RESERVED.

RSS Feed

RSS Feed