|

As Estate Planning Attorneys, one thing that we cannot stress enough is the importance of having a will in place. Having a will is the only way to be certain that your wishes for your family and your estate will be honored when you pass away. Without a will, state laws determine what happens to your estate and even to your minor children. In the video below, attorney Kelly Jesson talks about some things that can happen if you pass away without a will in North Carolina. Please call Jesson & Rains if you have questions about getting your will prepared or updating an existing will.

0 Comments

By Associate Attorney Katy Currie

Valentine’s Day is a holiday to celebrate the endless love we have for the loves of our life. What better present to give your Valentine this year than ensuring your estate planning is done? There are many important aspects of sitting down and planning for your future through your estate planning documents, and unfortunately, there are countless issues that could arise without proper estate planning. Without a will you lose the control you have over who inherits what when you pass away, and this could have huge implications on your loved ones. You are deemed to have died “intestate” if you die without a will. North Carolina has an Intestate Succession Act which is the default law that kicks in if you should pass away without a will. It names which of your surviving family members are considered your legal heirs in North Carolina. The most common misconception surrounding intestate succession is that your spouse will inherit everything if you pass away without a will. This is not always the case if you have probate property and are survived by children or parents in addition to a spouse. For example, if you do not have a will and are survived by a spouse and one child (or grandchildren if that child is deceased), or a spouse and a living parent if you have no children or grandchildren, in addition to receiving the $60,000 spousal allowance, your surviving spouse takes the first $60,000 of your personal property, ½ of your real property, and ½ of whatever remains of your personal property while the child/grandchildren/parent inherits the remainder. If you are survived by multiple children or grandchildren, that number is cut to 1/3. Additionally, in North Carolina, a will is the only way to name a guardian for your minor children in the event both parents pass away. You can also create a testamentary trust within your will, which will name a trustee who can be the money manager for inheriting children until they reach a certain age (later than the default age of 18). So, while enjoying a nice romantic dinner to celebrate and show your love for your Valentine, it is also an opportunity to discuss planning for your future while you have some alone, intimate time together. If you approach the conversation with care and thoughtfulness, it could help you break the ice for those difficult, but important, decisions for your estate plan which will have a positive impact on your Valentine for years to come. If you would like to take the next step and work on your estate plan, give Jesson & Rains a call! By Associate Attorney Katy Currie

As the holiday season rolls around, our focus often shifts to spreading joy, giving gifts, and cherishing time with loved ones. However, amidst the festive cheer, there might be family dynamics that don't always align with the holiday spirit. If you find certain family members perpetually landing on the metaphorical “naughty list,” it might be time to consider updating your estate plan to ensure your wishes are safeguarded regardless of family conflicts or disputes. If certain family members have a history of conflicts or strained relationships, it's crucial to communicate your intentions clearly in your estate plan. Explicitly outlining your decisions regarding asset distribution, guardianship, or decision-making authority in your estate plan can help avoid ambiguity and potential disputes. In some cases, you may want to explore options to protect your assets or ensure they are utilized according to your wishes, especially if you are concerned about how certain family members might handle their inheritance. Without a will or living trust, your assets would pass according to the intestacy laws of North Carolina. This takes away the control you have over who inherits when you pass away and could have huge implications on your loved ones. Additionally, in North Carolina, a will is the only way to name a guardian for your minor children in the event that both parents pass away. Furthermore, some people may require more complex estate planning depending on their family situation (such as second marriages, a child with special needs, or care of minor children) and the type and amount of their assets. Estate planning through devices such as living trusts allows you to put plans in place to address the specific needs of your beneficiaries, avoid the probate process, and address more complex tax issues depending on your assets. Finally, a comprehensive estate plan not only plans for what happens after death, but also addresses who would be responsible for making decisions on your behalf if you became incapacitated during your lifetime. This includes naming someone to make financial decisions on your behalf and someone to make medical decisions on your behalf. Without such a plan, your family may have to go through more drastic and expensive court proceedings to have you deemed legally incompetent by a judge. While it's essential to address concerns about family dynamics in your estate planning, doing so should be approached with careful consideration and guidance from professionals. The goal is not only to protect your assets but also to ensure your intentions are upheld and respected, even in challenging family situations. As you prepare for the holiday season, take a moment to consider the importance of estate planning in securing the future for yourself and your loved ones, even when navigating the complexities of family dynamics. If you approach the topic with honesty, care, and thoughtfulness, it could help you get the ball rolling on making important decisions for your estate plan that will have a positive impact on your family for years to come. Jesson & Rains, PLLC wishes you a joyous holiday season filled with love, laughter, and thoughtful planning for the future! By Shayla Martin

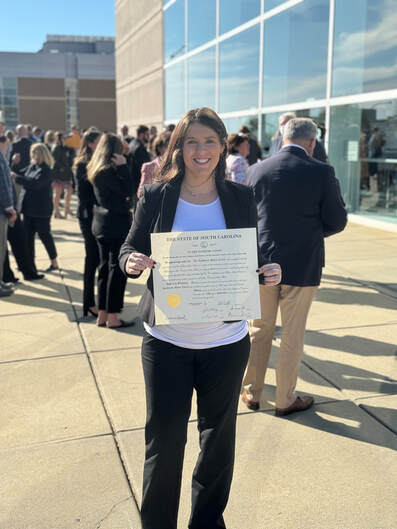

We are thrilled to announce the new licensure of attorney Katheryn “Katy” Currie in the state of South Carolina. Katy initially joined our team in November of 2022 with licenses in North Carolina as well as Alabama. Katy has been a dedicated and passionate advocate for her clients for several years, and her expansion into South Carolina is a testament to her commitment to providing exceptional legal services. Her experience and expertise in various areas of the law, including probate administration, estate planning, and business transactions, will undoubtedly benefit individuals and businesses throughout South Carolina. Along with Katy, our experienced legal team is ready to assist with probate matters, guiding you through the complexities of estate administration and ensuring the smooth transfer of assets to beneficiaries after the death of a loved one. Our estate planning services include wills, trusts, powers of attorneys, and advanced directives, ensuring that your assets are protected and your wishes are honored. Finally, for businesses in South Carolina, we offer a wide range of legal services, including contract drafting, business formation, and more. We're here to help you navigate the complexities of the business world while protecting your interests. Coming Soon: South Carolina construction and litigation services. We’re also happy to announce that partner Edward Jesson passed the South Carolina bar this fall and is expected to be licensed in SC early next year. By Associate Attorney Katy Currie

National Estate Planning Awareness Week was adopted in 2008 to help the public understand what estate planning is and why it is important for all people, not just the uber-rich. An “estate” does not necessarily mean something like the Biltmore Estate. Everyone has an estate, even small or insolvent estates. Estate planning is more than money – estate planning allows you to gain control and peace of mind over difficult and unpredictable situations. We have previously written about the difficulties caused by dying without a will in North Carolina and the pitfalls of the probate process in North Carolina; however, many of the “worst-case” scenarios can be avoided with proper planning. Let us help you plan for emergency scenarios and protect your business and personal assets for the benefit of your loved ones through estate planning. Unfortunately, COVID-19 has shown us that there are no guarantees, but it has also highlighted what is most important to each of us: family. Estate planning allows you to plan for what happens when you pass away, including naming a trusted person to handle your final affairs, name guardians for minor children, and distribute your assets according to your wishes. In addition to planning for death, our office drafts durable and health care powers of attorneys, where you can name agents to make both financial and medical decisions for you if you are incapacitated and cannot communicate. There is no reason to wait to do planning, and as we age and the pandemic continues to be a part of our “new normal,” you should get a plan in place before it is ever needed. If you do become incapacitated or ill, it may be more difficult or impossible to get documents in place, as you must have testamentary capacity to create valid estate planning documents. Some of our clients delay estate planning because they do not have any friends or family members they trust to serve in fiduciary roles. In some circumstances, members of the firm may serve in these roles for the client if the client feels comfortable. It is better for you to take control and name someone yourself than to have the government appoint someone in an emergency or when you pass away. National Estate Planning Awareness Week is a great time for you to take CONTROL! Please call Jesson & Rains if you have questions about getting your estate plan in order or updating an existing estate plan. While You Build, We Protect. By Associate Attorney Katy Currie

August is National Make-A-Will Month! While it may not be as fun as celebrating one of August’s other “holidays,” like National S’mores Day (August 10) or National Dog Day (August 26), it is a reminder of the importance of having a will in place to ensure that your loved ones are provided for at your passing. Some of the most important components of a will are: 1) Naming Beneficiaries to Inherit Your Assets: A will allows you to specifically provide for the persons or charities of your choosing at your passing. If you pass away without a will in North Carolina, the North Carolina Intestacy Statutes will determine where your assets will go based on your next-of-kin. For any property that was owned joint with rights of survivorship, which is frequently the case with many assets owned by spouses, the asset will pass automatically to the surviving party. As will assets that have a designated beneficiary via a beneficiary designation. However, this is not the case for any assets that are just in your name when you pass away, even if you are survived by your spouse. Under the North Carolina Intestacy Statutes, most people are surprised to learn that your spouse does not automatically inherit everything. Sometimes parents or half-siblings inherit. Thus, without a will, you may be inadvertently leaving your assets to people who do not need them, or you may be leaving assets to minor children instead of your spouse, who may need the funds to care for your children. A will also allows you to leave assets to more distant relatives, friends, or charities that would be ineligible to inherit through intestacy. 2) Naming an Executor. Your will allows you to name an Executor to manage your assets and distribute them to your beneficiaries at the time of your death. Without a will, you will not have any control over naming the person to manage your affairs at your death and a family member or friend will have to volunteer and seek the court’s approval before being allowed to serve. If someone has a higher degree of kinship than the prospective Executor, they must sign a waiver of their right to serve as Executor (i.e., creating more paperwork for your loved ones). If the person will not waive their right to serve, this may result in a person who is not as well-suited for the job serving as an Executor just because they have a higher degree of kinship than the prospective Executor. 3) Waiving the Executor’s Bond. In North Carolina, an Executor has to pay a bond based on the value of the assets unless (1) it is waived in a will or (2) all heirs sign a waiver to waive the requirement (again, more paperwork for your loved ones). If there are minors or incompetent heirs, they cannot consent, and the bond will be required. Any Executor who is not a North Carolina resident must pay a bond, regardless of the waiver. By planning with a will, you can waive the requirement altogether and make sure your desired Executor is capable of serving. 4) Name a Guardian and Trustee for Minor Children. In North Carolina, the only way to name a guardian for your children if both parents pass away is to name the guardian in a will. Without a will, multiple family members may seek to be appointed a child’s guardian, which may result in fighting or someone serving that you would not have chosen yourself for that role. You can also create a testamentary trust in your will, which allows you to have more control over the age when your children inherit. With this trust, your named Trustee will manage and distribute assets for your children’s benefit until they reach the age where you designate that they can manage the funds on their own. Without a will, any person eighteen years or older can inherit any type of asset without the benefit of a Trustee’s oversight. If you do not have a will, or your existing will does not accurately reflect your current wishes, use Make-A-Will Month to get a plan in place so that your loved ones are not left with questions or complications if you pass away. Please call Jesson & Rains if you would like to discuss how a will can be tailored to your specific needs and wishes! |

Subscribe to our newsletter.AuthorKelly Rains Jesson Categories

All

Archives

July 2024

|

|

SERVICES |

SUPPORT |

©Jesson & Rains, PLLC ALL RIGHTS RESERVED.

RSS Feed

RSS Feed